匠心、匠艺、匠品、匠魂

铝金属工艺设计定制生产厂家

Pursue design style and create Seiko quality

Pursue design style and create Seiko quality

现代简约风格

现代简约风格 新中式风格

新中式风格 北欧风格

北欧风格 轻奢风格

轻奢风格 美式风格

美式风格 中式风格

中式风格 法式风格

法式风格

现代简约风格装饰效果图

新中式风格装饰效果图

北欧风格装饰效果图

轻奢风格装饰效果图

美式风格装饰效果图

中式风格装饰效果图

法式风格装饰效果图

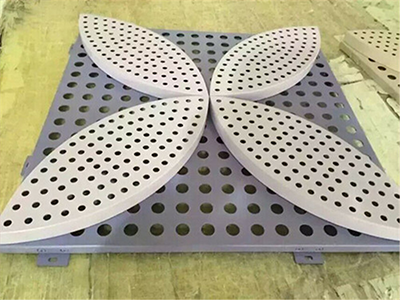

公司配备数控转塔冲床,极大地提高了产品加工精度及生产效率

采用新型图纹装饰材料,图案高档华丽、图纹牢固耐磨、形状雅致多样

从工程设计到产品的生产检验施工安装及服务,都严格按照质量保证体系

咨询我们每年10款以上更新速度,积累丰富款式,全面满足客户的多样化需求

raybet56雷竞技面平整度高,表面坚固,耐用,整齐且绝缘性好,不易褪色不易变形

注重研发、设计,经过多年持续与积累,并有专业研发团队,使产品不断更新

咨询我们拥有科学的施工规范与质量管控体系,为项目提供高质量、高效保障

我们拥有专业的设计制作及安装团队,保证每一件产品都是精心制作

从售前的产品设计、售中产品定制、灵活供应,到售后的技术指导、解决方案提供,厂家一站式为客户服务,更省成本

咨询我们

福州雷竞技RAYBETraybet56雷竞技厂家是一家集设计、销售和安装raybet56雷竞技生产厂家,主要生产冲孔raybet56雷竞技、真石漆raybet56雷竞技、幕墙raybet56雷竞技、雕花raybet56雷竞技、室内造型raybet56雷竞技、氟碳raybet56雷竞技、木纹raybet56雷竞技、仿古raybet56雷竞技等系列产品。专业承接酒店会所,商业办公楼,售楼中心,别墅,高端住宅,餐饮等行业装饰工程,企业经过多年发展,raybet56雷竞技以诚信赢客户,品质赢市场,我们不断创新与广大用户携手共进,欢迎各界同仁来电咨询。

查看更多

目前,在很多城市建筑里面都会看到大型的板块镶嵌在墙壁上,显得整个建筑更加端正和宏伟,但是很多场合都选择冲孔raybet56雷竞技

据了解,雕花铝板是根据古代的技术而研发制作出来的,用雕刻机在表面进行设计图案,种类繁多,在装饰材料市场十分火热,

雷竞技RAYBET是一家集冲孔raybet56雷竞技的设计、生产、销售、安装,售后服务于一体的现代化企业。技术支持:

备案号:闽ICP备2022004884号-1 | 网站地图 XML地图